How to Start Investing in India (Beginner’s Step-by-Step Guide)

If you want to start investing in India, this beginner-friendly guide will show you exactly how to begin step by step.

We keep money in savings accounts, FDs, or gold — thinking it is “safe”.

Meanwhile, inflation silently eats our purchasing power every single year.

If your money grows at 4% and inflation is 6%, you are actually losing money.

That is why investing is not optional anymore it is necessary for financial freedom.

Whether you want:

- A comfortable retirement

- Financial independence (FIRE)

- Wealth for your family

- Or simply peace of mind

You must learn how to invest properly.

The good news?

You do not need lakhs to start.

You do not need to understand the stock market deeply.

You do not need to take crazy risks.

You just need a structured system.

This guide will show you:

- ✔ What to do before investing

- ✔ Where beginners should start

- ✔ How SIP actually builds wealth

- ✔ Mistakes to avoid

- ✔ A simple roadmap you can follow today

By the end of this page, you’ll know exactly how to begin your investment journey in India – step by step.

Step 1 – Build Your Financial Foundation Before Investing

Before you invest a single rupee in mutual funds or stocks, you need a strong base.

Investing without a foundation is like building a house without cement.

It may stand for some time – but the first storm will shake it.

Many beginners lose confidence in investing not because markets are bad,

but because they were financially unprepared.

Here is what you must fix first.

1️⃣ Build an Emergency Fund

Life is unpredictable.

Medical emergencies, job loss, family responsibilities – they come without warning.

If you are forced to withdraw your investments during a crisis,

you break the compounding cycle.

That is why your first goal is simple:

Save at least 6 months of essential expenses in a liquid and safe place.

This money should not be invested in stocks.

Keep it in:

- High-interest savings account

- Liquid mutual fund

- Short-term FD

This fund protects your investments from panic withdrawals.

2️⃣ Get Health Insurance

One hospital bill can destroy years of savings.

If you depend only on your employer’s policy, you are exposed to risk.

A separate health insurance policy ensures that your investments remain untouched during medical emergencies.

Investing without insurance is not smart investing.

3️⃣ Take Term Insurance (If You Have Dependents)

If your family depends on your income,

term insurance is not optional.

It is protection.

It ensures that your long-term wealth plan continues even if something happens to you.

Insurance is not an investment.

It is a safety net.

4️⃣ Clear High-Interest Debt First

If you are paying:

- 36% credit card interest

- 18% personal loan interest

And expecting 12% returns from investing —

the math will not work in your favour.

Clear high-interest debt first.

Then invest.

Why This Step Matters

When your foundation is strong:

- You don’t panic during market crashes

- You don’t stop SIPs suddenly

- You don’t sell investments at a loss

- You invest with confidence

Successful investors are not fearless.

They are prepared.

Step 2 – Understand Investment Basics (Without Complication)

Before putting money into any investment, you must understand one simple truth:

Investing is not gambling.

It is not guessing.

It is not following tips.

It is not trying to double money quickly.

Investing is the process of putting your money into assets that grow over time.

That’s it.

Once you understand a few core ideas, everything becomes simple.

What Is Investing?

When you invest, you are giving your money a job.

Instead of sitting idle in a savings account, your money starts working for you.

For example:

- When you invest in stocks, you own a part of a company.

- When you invest in mutual funds, professionals invest your money across multiple companies.

- When you invest in bonds or debt funds, you are lending money and earning interest.

The goal is long-term growth.

Risk and Return (The Most Important Concept)

Every investment has two sides:

Higher potential return = Higher risk

Lower risk = Lower return

A savings account is very safe — but returns are low.

Equity (stocks) can grow fast — but prices fluctuate.

The mistake beginners make is either:

- Taking too much risk too early

- Or avoiding risk completely

Smart investing is about balance.

Understanding Asset Classes

Think of asset classes as different “buckets” where you can invest.

Here are the main ones in India:

1️⃣ Equity

This includes:

- Stocks

- Equity mutual funds

- Index funds

Equity gives higher long-term growth.

But prices move up and down in the short term.

Best for long-term goals (5+ years).

2️⃣ Debt

This includes:

- Debt mutual funds

- Bonds

- Fixed deposits

Debt is more stable but gives lower returns compared to equity.

Good for short-term goals and stability.

3️⃣ Gold

Gold protects against uncertainty and inflation.

It doesn’t create income like businesses do,

but it adds diversification to your portfolio.

4️⃣ Real Estate

Property is a traditional Indian investment.

It requires high capital and is less liquid,

so it’s usually not a beginner’s first choice.

Why You Should Not Invest in Only One Asset

Putting all money into one asset is risky.

If markets fall and all your money is in stocks,

you panic.

If all your money is in FD,

your wealth grows too slowly.

This is why smart investors use asset allocation —

a mix of equity and debt based on goals and risk tolerance.

We’ll discuss how to structure that in later sections.

The Power of Time

The most powerful factor in investing is not skill.

It is time.

Starting early matters more than starting big.

Even ₹1,000 per month invested consistently for 15–20 years can create significant wealth due to compounding.

The earlier you start,

the less pressure you feel later.

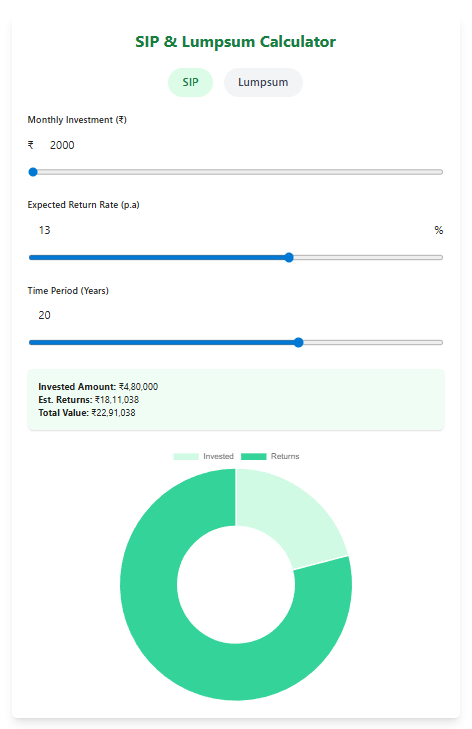

Click to check our free SIP & Lumpsum Calculator

Here is a quick comparison of best investment options in India:

| Investment Type | Risk | Returns | Best For |

|---|---|---|---|

| Fixed Deposit (FD) | Low | 5–6% | Safety |

| Mutual Funds | Medium | 10–12% | Growth |

| Stocks | High | 12–15% | Long term |

| PPF | Low | 7–8% | Safe retirement |

Step 3 – Why Mutual Funds & SIP Are Best for Beginners

If you are new to investing, you do not need to pick stocks.

You do not need to track markets daily.

You do not need to watch business news every evening.

For most beginners in India, the simplest and smartest starting point is:

Mutual funds through SIP.

Let’s understand why.

What Is a Mutual Fund?

A mutual fund pools money from many investors.

That money is managed by professional fund managers who invest in:

- Top Indian companies

- Bonds

- Government securities

- Or a mix of assets

Instead of buying one stock,

you indirectly own many companies.

This reduces risk.

You don’t depend on one company’s performance.

What Is SIP?

SIP means Systematic Investment Plan.

It simply means investing a fixed amount every month.

For example:

- ₹1,000 per month

- ₹5,000 per month

- ₹10,000 per month

The amount gets automatically invested in your chosen mutual fund.

No stress.

No timing the market.

No emotional decisions.

Just discipline.

Why SIP Works So Well

1️⃣ It Builds Discipline

Most people spend first and invest later.

SIP reverses that habit.

You invest first.

Over time, this small habit builds massive wealth.

2️⃣ It Reduces Timing Risk

Trying to guess when markets are low or high is almost impossible.

With SIP:

- When markets fall, you buy more units.

- When markets rise, you buy fewer units.

Over time, your average cost becomes balanced.

This is called rupee cost averaging.

3️⃣ It Uses Compounding

Compounding is when your returns start generating returns.

Example:

If you invest ₹5,000 per month for 15 years at 12% average return,

you could build a corpus of over ₹25–30 lakhs.

The longer you stay invested,

the faster wealth grows.

Time + consistency = compounding power.

Why Not Direct Stocks as a Beginner?

Stocks require:

- Research

- Emotional control

- Time

- Risk tolerance

Many beginners panic when markets fall 10–20%.

Mutual funds reduce this emotional pressure.

That’s why most salaried professionals should start with:

- Index funds

- Large-cap funds

- Or balanced funds

Simple. Diversified. Practical.

How Much Should You Start With?

Start small.

Even ₹500 or ₹1,000 per month is enough.

The goal is not to invest big.

The goal is to start.

You can increase SIP later as your income grows.

Starting late costs more than starting small.

A Simple Beginner Formula

If you are under 35:

- 70–80% equity mutual funds

- 20–30% debt funds

If you are above 40:

- Slightly higher allocation to debt

We will explain asset allocation more clearly in the strategy section.

Step 4 – How to Open Your First Investment Account in India

Starting today is easier than ever.

You don’t need to visit banks.

You don’t need paperwork.

You don’t need large capital.

The entire process can be completed online in less than 30 minutes.

Here’s how it works.

Step 1: Complete Your KYC

KYC means Know Your Customer.

It is mandatory before investing in mutual funds or stocks.

You will need:

- PAN card

- Aadhaar card

- Bank account

- Mobile number linked to Aadhaar

Most platforms complete KYC digitally through OTP verification and video confirmation.

Once KYC is approved, you can start investing immediately.

Step 2: Choose Where to Invest

You have two main routes:

1️⃣ Mutual Fund Platforms (Direct Investment)

You can invest directly through:

- AMC websites

- Direct mutual fund platforms

This avoids distributor commissions.

Lower cost = higher long-term returns.

2️⃣ Demat Account (For Stocks + Mutual Funds)

If you want flexibility to:

- Buy stocks

- Buy ETFs

- Invest in mutual funds

You can open a Demat account with brokers like:

- Zerodha

- Groww

- Upstox

The process is fully online.

There are no large opening fees anymore.

For beginners starting with SIPs, either route works.

Keep it simple.

Step 3: Select a Fund

As a beginner, don’t overthink.

Start with:

- A Nifty 50 Index Fund

- Or a large-cap mutual fund

These invest in India’s top companies and are relatively stable compared to small-cap funds.

You don’t need 5–6 funds initially.

Even one good diversified fund is enough to begin.

Step 4: Start Your SIP

Choose:

- Investment amount

- SIP date

- Bank auto-debit mandate

Once set, your investment runs automatically.

No manual effort required.

This automation removes emotional decision-making.

Direct vs Regular Plans (Important)

Always choose Direct Plan if you are investing on your own.

Regular plans include distributor commission,

which slightly reduces your long-term returns.

Over 15–20 years, even a 1% difference matters a lot.

How Long Does It Take?

- KYC: Same day or 1–2 days

- SIP activation: Within 3–5 working days

After that, your investment journey officially begins.

Simple. Structured. Powerful.

Step 5 – Build a Long-Term Investment Strategy

Starting your investment journey is important.

But staying invested for the long term is what actually builds wealth.

Most beginners focus too much on selecting the “best fund” or the “best stock.”

Very few focus on building a simple, sustainable strategy.

And strategy matters more than selection.

Let’s build yours.

Think in Years, Not Months

Markets move every day.

Prices go up. Prices go down. News keeps changing.

But real wealth is not built in 3 months or 1 year.

Equity investing works best over long periods — ideally 7 to 10 years or more.

There will be:

• Market crashes

• Corrections

• Slow years

• Unexpected global events

These are normal.

Long-term investors understand that volatility is temporary, but growth over decades is powerful.

If you keep a long horizon, short-term noise stops affecting you.

Do Not Try to Time the Market

Many beginners delay investing because they are waiting for the “perfect time.”

They think:

“I will invest when the market falls.”

“I will start after elections.”

“I will wait until things are stable.”

Markets are never perfectly stable.

If you are investing through SIP, you do not need perfect timing.

Consistency beats timing.

The investor who starts today and stays consistent usually beats the one who keeps waiting.

Focus on Asset Allocation

Asset allocation means deciding how much to invest in:

• Equity

• Debt

This decision is more important than choosing a specific mutual fund.

A simple starting framework:

If you are under 35, you can keep a higher allocation to equity because you have time to handle volatility.

As you grow older or move closer to important goals, increase your debt allocation to reduce risk.

The right mix helps you sleep peacefully during market downturns.

And calm investors make better decisions.

Review Once a Year (Not Daily)

Checking your portfolio every day increases stress.

Instead, review your investments once a year.

Ask yourself:

• Is my allocation still aligned with my goals?

• Has equity grown too large compared to debt?

• Do I need to rebalance?

Rebalancing means adjusting your portfolio back to your original allocation.

For example, if equity grows significantly and becomes 85% instead of 70%, you can shift some profits into debt.

This keeps your risk under control.

Increase SIP as Your Income Grows

One powerful strategy many investors ignore is SIP step-up.

Whenever your salary increases, increase your SIP amount.

Even a 5–10% increase every year can dramatically improve your final corpus.

Small increments over time create exponential growth through compounding.

Ignore Market Noise

There will always be:

• Breaking news about crashes

• Social media tips promising quick profits

• Fear during global events

If your foundation is strong and your strategy is clear, you do not need to react emotionally.

Investing should feel boring.

Boring investing builds exciting wealth.

The Simple Long-Term Formula

Start early.

Invest regularly.

Stay invested.

Increase contributions.

Review annually.

That is how long-term wealth is built in India.

Common Investing Mistakes Beginners Must Avoid

Investing is simple.

But human behavior makes it complicated.

Most people don’t lose money because markets are bad.

They lose money because of poor decisions.

If you avoid the mistakes below, you are already ahead of most investors.

1️⃣ Investing Without an Emergency Fund

Many beginners start SIPs immediately.

But when an unexpected expense comes, they withdraw their investments.

This breaks compounding.

And often they withdraw during market downturns — locking in losses.

Your emergency fund protects your investments from panic selling.

Foundation first. Investing second.

2️⃣ Chasing High Returns

Everyone wants the “best performing fund.”

But past performance does not guarantee future results.

Funds that performed extremely well last year may underperform next year.

Chasing returns usually means:

• Buying high

• Selling low

Instead of chasing performance, focus on consistency and asset allocation.

3️⃣ Investing Based on Tips

Friends, WhatsApp groups, social media influencers — everyone has stock tips.

But most of these tips are short-term speculation.

Investing without understanding what you’re buying is risky.

If you cannot explain in simple words why you are investing in something, you probably shouldn’t invest in it.

4️⃣ Stopping SIP During Market Crash

This is one of the biggest wealth-destroying mistakes.

When markets fall 20–30%, fear increases.

Many investors stop their SIPs thinking they are “saving money.”

But market crashes are when SIP works best.

You accumulate more units at lower prices.

Historically, markets recover over time.

The investors who continue during crashes benefit the most during recovery.

5️⃣ Over-Diversification

Some beginners open:

• 5–6 mutual funds

• Multiple overlapping schemes

• Different small investments without strategy

This creates confusion, not diversification.

Too many funds make tracking difficult and reduce meaningful growth.

For beginners, 1–3 well-chosen funds are enough.

6️⃣ Expecting Quick Results

Investing is not a shortcut to instant wealth.

If you expect your portfolio to double in 1–2 years, you will be disappointed.

The real power of investing appears after 7–10 years.

Patience is not optional.

It is required.

7️⃣ Ignoring Costs

Small differences in expense ratio matter over 15–20 years.

Choosing direct plans instead of regular plans can significantly increase your final corpus.

Costs compound just like returns do.

Lower cost = higher long-term wealth.

The Truth About Successful Investors

Successful investors are not lucky.

They:

• Avoid big mistakes

• Stay disciplined

• Ignore noise

• Think long-term

If you avoid these common errors, your probability of building wealth increases dramatically.

Frequently Asked Questions About Starting to Invest in India

1️⃣ How much money do I need to start investing in India?

You can start investing with as little as ₹500 per month.

Many mutual funds allow SIP investments starting from ₹500 or ₹1,000.

The important thing is not the amount.

It is the habit.

Starting early with a small amount is better than waiting to invest a large amount later.

Time matters more than size.

2️⃣ Is SIP safe for beginners?

SIP itself is not an investment product.

It is a method of investing regularly.

The safety depends on the type of mutual fund you choose.

If you invest in diversified equity mutual funds for the long term (5+ years), SIP is considered a disciplined and practical approach for beginners.

It reduces timing risk and builds consistency.

3️⃣ Can I invest ₹1,000 per month and still build wealth?

Yes.

Wealth is built through consistency and time.

₹1,000 invested monthly for 15–20 years can grow significantly due to compounding.

As your income increases, you can increase your SIP amount.

Small beginnings can lead to large outcomes.

4️⃣ What is better: Fixed Deposit or Mutual Fund?

Fixed Deposits are safer and offer stable returns.

Mutual funds, especially equity funds, offer higher growth potential but with short-term fluctuations.

If your goal is long-term wealth creation and beating inflation, equity mutual funds are generally better than FDs.

For short-term goals or stability, FDs or debt funds are suitable.

The right choice depends on your time horizon and risk tolerance.

5️⃣ When is the best time to start investing?

The best time to start investing is as early as possible.

Waiting for the perfect market condition often leads to delay.

If you are investing through SIP and have a long-term horizon, starting today is usually better than waiting.

Time in the market is more important than timing the market.

6️⃣ Do I need a Demat account to invest in mutual funds?

No.

You can invest in mutual funds directly without a Demat account through AMC websites or direct mutual fund platforms.

However, if you want to invest in stocks or ETFs, you will need a Demat account.

For beginners starting with SIPs in mutual funds, Demat is optional.

7️⃣ Should I invest in multiple mutual funds at the beginning?

No.

Beginners often overcomplicate things.

Starting with one or two well-diversified funds is enough.

As your knowledge and investment amount grow, you can gradually expand your portfolio.

Keep it simple in the beginning.

8️⃣ What happens if the market crashes after I start investing?

Market crashes are a normal part of investing.

If you are investing through SIP and have a long-term horizon, crashes can actually benefit you because you accumulate more units at lower prices.

Historically, markets have recovered over time.

The key is to stay invested and not panic.

Your Investment Journey Starts Now

You do not need to be a finance expert to build wealth.

You do not need lakhs to begin.

You do not need to predict the stock market.

You only need a simple plan and the discipline to follow it.

Let’s quickly recap the roadmap:

• Build your financial foundation

• Understand basic asset classes

• Start with mutual funds and SIP

• Open your investment account

• Follow a long-term strategy

• Avoid common mistakes

That’s it.

Wealth creation in India is no longer complicated.

With online platforms, low-cost mutual funds, and SIP flexibility, investing has become accessible to everyone — including salaried professionals starting small.

The biggest mistake now is not starting.

Every year you delay, you lose valuable compounding time.

Every month you invest, you move one step closer to financial freedom.

Take Action Today

The best time to start investing in India is today.

Start a small SIP.

Choose one diversified mutual fund.

Commit for the next 10 years.

Do not focus on short-term returns.

Focus on consistency.

Your future self will thank you.