Budget Smarter. Save More. Invest Wisely.

📍 Introduction :

Managing personal finance is one of the most essential life skills — yet it’s often ignored until it’s too late.

Whether you’re a student, working professional, or small business owner, this guide will help you take full control of your money.

From budgeting and saving to investing and debt management — let’s simplify personal finance step by step.

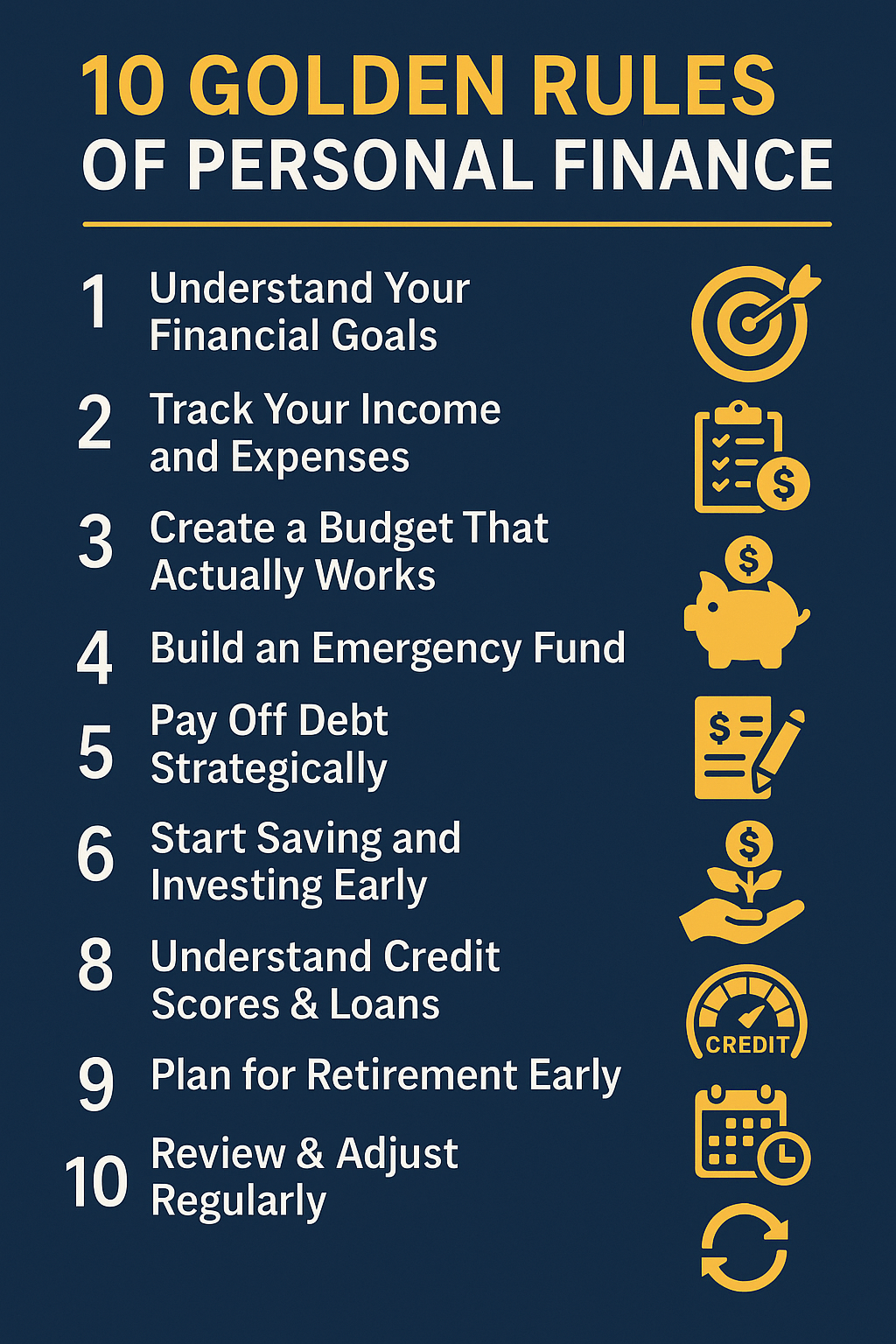

🔹 1. Understand Your Financial Goals

Financial goals act as the blueprint for your financial planning. Without them, it’s easy to get distracted by short-term desires or make decisions that don’t align with your future.

Setting clear financial goals gives you purpose and motivation and serves as the foundation for all your financial decisions.

Understanding your financial goals begins with asking yourself, “What do I want my money to achieve for me?” This may vary based on life stage, career path, family responsibilities, or personal aspirations.

Examples include building an emergency fund, paying off a loan, buying a house, saving for your child’s education, or planning an early retirement.

Start by writing down everything you wish to achieve financially. Make this a brainstorming exercise — from small dreams to big life milestones.

Once you have a list, organize them by timeline:

Types of Financial Goals:

- Short-term Goals (within 1 year):

These include things like building a ₹1 lakh emergency fund, saving for a new laptop, planning a domestic trip, or clearing a small credit card debt.

These goals typically require quick, low-risk financial decisions and disciplined saving. - Medium-term Goals (1–5 years):

Medium-term objectives might include purchasing a vehicle, saving for a wedding, funding a business idea, or building a down payment for a house.

These goals can be met with a balanced mix of savings and conservative investments like fixed deposits or short-duration debt mutual funds. - Long-term Goals (5+ years):

These are often life-defining goals such as retiring comfortably, funding your child’s higher education, or buying your dream home.

These goals can be achieved using equity-based mutual funds, index funds, NPS, or other growth-oriented instruments.

🔹 2. Track Your Income and Expenses

If you don’t know where your money is going, you can’t optimize it. Tracking income and expenses is the most fundamental step in taking control of your finances.

It creates awareness and reveals spending habits that may be draining your resources unknowingly.

This step alone can help you uncover financial leakages, eliminate unnecessary expenses, and build a budget that works.

Start by understanding your sources of income. This includes your salary, freelance earnings, interest from bank accounts or investments, rental income, or even side hustles.

Then list out all your expenses — fixed and variable.

How to Track:

- Manual Methods:

Maintain a notebook, diary, or Excel spreadsheet. Log daily expenses by category. This method increases awareness and accountability. - Apps:

Use digital tools like Money Manager, Walnut, Spendee, YNAB (You Need A Budget), Goodbudget, or mobile-friendly Google Sheets templates.

These apps help you auto-sync bank transactions, set spending limits, and track patterns over time.

Review Financial Statements:

- Review your bank statements, UPI transaction logs, and credit card bills every week or month.

Look for recurring auto-debits, subscriptions, impulse purchases, or duplicate charges. These small reviews can help you cut expenses by up to 10–15% monthly.

Categorize Expenses:

Break down your spending into three primary categories:

- Needs: Non-negotiables like rent, groceries, EMI, transport, healthcare, electricity

- Wants: Dining out, OTT subscriptions, online shopping, entertainment

- Savings & Investments: SIPs, RD, PPF, retirement contributions, insurance premiums

By analyzing this breakdown, you can see whether you’re overspending on wants or under-saving.

Pro Tip:

Use the 70-20-10 rule if you’re just starting out:

- 70% of your income for expenses (needs + wants)

- 20% for investments

- 10% for short-term savings or debt repayment

Tracking isn’t a one-time activity — it’s a habit. Set weekly reminders to log your transactions or check your app dashboard. With consistent tracking, you’ll be more mindful of your money, more confident in your financial decisions, and more aligned with your long-term goals.

🔹 3. Create a Budget That Actually Works

A budget isn’t a punishment — it’s a plan for your money. The key is to find a system that matches your lifestyle, income, and preferences.

Popular Budgeting Methods:

50/30/20 Rule:

This method is simple yet effective, especially for beginners. You divide your after-tax income into three buckets:

- 50% Needs: This includes housing, groceries, transportation, utilities, EMIs, and essentials.

- 30% Wants: Lifestyle choices such as dining out, entertainment, gadgets, and shopping.

- 20% Savings: This covers your investments, debt repayments, emergency fund, and future planning.

The 50/30/20 rule promotes balanced living — allowing for enjoyment while ensuring financial responsibility. Adjust percentages if needed based on your goals (e.g., 40/30/30 for more aggressive saving).

Zero-Based Budgeting:

In this method, every rupee you earn is assigned a job. Your income minus all expenses and savings should equal zero by the end of the month. This ensures nothing is left idle or wasted.

For example, if you earn ₹50,000, your budget might include ₹15,000 for rent, ₹10,000 for groceries and transport, ₹5,000 for fun, ₹10,000 for SIPs, and ₹10,000 for loan repayments — totaling ₹50,000. It’s ideal for those who want total control and accountability over their money.

Envelope System:

Great for cash users or those who overspend on variable expenses. Withdraw cash and place it into physical envelopes labeled with categories like “Groceries,” “Dining,” “Petrol,” etc. Spend only from these envelopes and stop when they’re empty.

This method limits overspending and promotes discipline. It can also be adapted digitally using apps like Goodbudget that simulate envelope-based budgeting.

- Automate fixed expenses (like rent, insurance)

- Track variable spending weekly

- Create separate accounts for savings vs. spending

- Include ‘fun’ money to prevent burnout

Consistency beats perfection. Even a rough monthly budget will outperform no plan at all.

🔹 4. Build an Emergency Fund

An emergency fund is a financial cushion for life’s unexpected blows — job loss, medical emergencies, or urgent repairs. It provides peace of mind and flexibility during hard times. Think of it as your financial safety net that prevents you from falling into debt or liquidating long-term investments in a crisis.

Why You Need It:

- Reduces stress and panic:

Knowing you have money set aside for emergencies gives you confidence and stability. - Prevents debt buildup:

Without a reserve, you might resort to high-interest credit cards or loans. - Gives time to recover: Whether it’s finding a new job or recovering from illness, you’ll have breathing space.

How Much is Enough?

- Start Small:

Even saving ₹5,000/month is a strong beginning. Small, consistent contributions add up over time. Focus on building momentum rather than perfection. - Ideal Target:

Aim for 3–6 months of your essential living expenses. This includes rent, groceries, EMIs, school fees, and utilities. For example, if your monthly expenses are ₹40,000, target at least ₹1.2–2.4 lakhs.

If you’re self-employed or have irregular income, consider a larger buffer of 6–12 months.

Where to Keep It:

- High-Interest Savings Account:

Offers quick access with minimal risk. Opt for banks that offer higher interest with online flexibility. - Liquid Mutual Funds: Provide better returns than a savings account, with 24–48 hour withdrawal time. Ideal for those comfortable with a bit of market exposure.

Avoid parking emergency funds in fixed deposits with lock-ins or in equities, as they are not instantly accessible or risk-free.

Best Practices:

- Keep it in a separate account labeled “Emergency Only” to avoid temptation.

- Automate monthly transfers to your emergency fund like a regular bill payment.

- Review it annually to adjust the amount as your lifestyle and expenses grow.

By maintaining a well-funded emergency reserve, you create a financial buffer that supports not just survival — but also the ability to make better, calmer decisions during stressful periods.

🔹 5. Pay Off Debt Strategically

Debt is a double-edged sword — useful when used wisely, dangerous when mismanaged. While some forms of debt like home loans or education loans can be considered investments in your future, high-interest debt such as credit card balances can quickly become a financial trap. Paying off debt is essential for reducing financial stress, improving your credit score, and freeing up cash for savings and investments.

Types of Debt:

- Good Debt: Loans used to acquire appreciating or income-generating assets. This includes student loans (investment in education), home loans (real estate ownership), and business loans (growth capital).

- Bad Debt: High-interest loans used for consumer purchases, such as credit card debt, payday loans, or EMIs for luxury items. These do not generate any financial return and often depreciate in value.

Repayment Strategies:

Debt Avalanche:

Focus on repaying the loan with the highest interest rate first while paying minimums on the rest. This method minimizes the total interest paid and helps you become debt-free faster. For example, if you have a credit card at 36% interest and a personal loan at 14%, pay off the credit card first.

Debt Snowball:

Pay off the smallest outstanding loan first to gain momentum and motivation. This method is psychological — you build quick wins that keep you encouraged. Once the smallest debt is gone, roll that EMI into the next smallest debt. Repeat until you’re debt-free.

Practical Tips:

- Negotiate Rates: Contact banks or NBFCs to request lower interest rates or restructuring of loans if you’re struggling.

- Avoid New Loans: Only take new credit if it helps build assets, such as a business or education loan. Avoid using loans to fund vacations, gadgets, or weddings.

- Use Windfalls Wisely: Bonuses, tax refunds, and monetary gifts should be directed toward high-interest debt first.

- Avoid Minimum Payments: Paying only the minimum on credit cards prolongs debt and increases interest burden exponentially.

Example:

If you owe ₹1.5 lakh on a credit card with 36% annual interest and make only the minimum payment of ₹5,000/month, it could take over 3 years to clear, costing you nearly ₹80,000 extra in interest. Paying an additional ₹2,000/month could cut the term by more than half.

Getting debt-free isn’t just a financial milestone — it’s a mindset shift. It opens up room to save, invest, and plan your life with freedom and confidence.

🔹 6. Start Saving and Investing Early

Saving alone doesn’t grow wealth — investing does. When you start early, your money has more time to grow due to the power of compounding. Compounding means you earn returns on your initial investment as well as the interest or gains that accumulate over time. The earlier you start, the greater your wealth creation potential — even with small monthly amounts.

Let’s say you begin investing ₹5,000 per month at age 25 in an instrument offering a 12% annual return. In 30 years, your investment will grow to over ₹1.7 crore. But if you delay and start at 35, you’ll accumulate only around ₹56 lakh. The difference is the reward of starting early.

Where to Start:

SIP (Systematic Investment Plan):

SIPs are one of the easiest and most effective ways to invest in mutual funds. You can begin with as little as ₹500 per month. SIPs promote disciplined investing and remove the stress of timing the market. Over the long term, they help build significant wealth by averaging out the cost of investments through market ups and downs.

For example, if you start a SIP of ₹3,000/month in an equity mutual fund yielding an average return of 12% annually, you’ll accumulate ₹35.2 lakh in 20 years.

Index Funds:

These are passively managed mutual funds that replicate the performance of a stock market index like the Nifty 50 or S&P 500. They have lower expense ratios, are diversified, and are ideal for long-term investors looking for steady growth with minimal management.

Advantages:

- Low cost

- Long-term performance mirrors the overall market

- Great for beginners who want to avoid stock picking

Start with funds like Nifty 50 Index Fund or Sensex Index Fund for Indian markets.

Public Provident Fund (PPF):

PPF is a government-backed savings scheme offering tax-free interest and a 15-year lock-in. It’s ideal for conservative investors or those looking to diversify across fixed-income instruments. You can invest up to ₹1.5 lakh annually, and it’s eligible for tax deduction under Section 80C.

Benefits:

- Safe and risk-free

- Tax-free returns

- Helps balance your equity investments

Fixed Deposits (FDs) and Recurring Deposits (RDs):

While returns are lower than equity instruments, FDs and RDs are safer and suitable for short-term or goal-based saving (e.g., buying a vehicle or planning a trip within 1–2 years).

Tips to Get Started:

- Start small but stay consistent

- Increase your investment amount annually with income hikes

- Use a goal-based approach (e.g., SIP for retirement, PPF for child’s education)

- Automate your investments for regularity

Remember: time in the market is more important than timing the market. The sooner you begin, the more wealth you can create with minimal effort.

🧮 Use our [SIP Calculator] to plan your returns

🔹 7. Understand Credit Scores & Loans

A credit score reflects your creditworthiness. It plays a vital role in determining your eligibility for loans and credit cards, as well as the interest rate you’ll be offered. The higher your score, the more trustworthy you appear to lenders, and the lower your borrowing costs. In India, scores from CIBIL, Equifax, and Experian typically range from 300 to 900, with anything above 750 considered excellent.

✅ Good Practices (Do’s):

- Pay bills on time: Timely EMI and credit card payments are the most significant factors in maintaining a good credit score. Set reminders or use auto-pay to ensure you never miss a due date.

- Use less than 30% of your credit limit: High credit utilization signals financial stress to lenders. If your limit is ₹1,00,000, try to use no more than ₹30,000. Paying your card balance in full each month is ideal.

- Check your CIBIL/Equifax report regularly: Monitoring your credit report helps you catch errors or fraudulent activity early. You are entitled to one free report annually from each bureau.

- Maintain a mix of credit types: A combination of secured (home loan) and unsecured (credit card) credit improves your profile.

- Keep old credit cards open: Length of credit history boosts your score. Closing an old card can actually harm your profile.

⚠️ Bad Practices (Don’ts):

- Avoid applying for too many loans or cards at once: Every loan application results in a ‘hard inquiry’ that can temporarily reduce your score. Multiple applications make you seem credit-hungry.

- Don’t miss EMI payments: Even a single missed or delayed payment can drop your score by 50–100 points and stay on record for years.

- Avoid maxing out your credit cards: Consistently maxing out limits is a red flag and lowers your score.

- Don’t close unused cards without reason: This can reduce your overall credit limit, increasing your utilization ratio.

Improving your credit score takes consistency. A higher score helps you negotiate better loan terms, access higher limits, and build financial confidence. Make credit responsibility a key part of your financial journey.

🔹 8. Protect Yourself with Insurance

Insurance is not an investment — it’s a financial safety net. It protects your family, wealth, and peace of mind in case of unforeseen events. No matter how well you save or invest, a single medical emergency, accident, or untimely death can derail your financial progress if you’re not properly insured.

🛡️ Must-Have Policies:

- Health Insurance: Every individual should have health coverage, even if an employer provides group insurance. Hospitalization costs are rising, and a simple surgery or treatment can cost lakhs. Opt for a base cover of at least ₹5–10 lakh. Consider a family floater plan for spouse and children. Top-up plans are great for increasing coverage at low premiums.

- Term Life Insurance: If you have financial dependents (spouse, children, parents), term insurance is a must. It offers high coverage (10–15x your annual income) at low premiums. In the event of your death, your family receives the sum assured tax-free. Term plans don’t offer returns, but that’s not their job — their job is protection.

Additional Policies (Optional But Useful):

- Critical Illness Cover: Provides a lump sum if diagnosed with major illnesses like cancer, stroke, or heart disease. This helps cover non-hospital expenses or income loss during recovery.

- Personal Accident Insurance: Pays for disability or accidental death. Especially recommended if you travel frequently or work in risky environments.

- Home Insurance: Protects your home and belongings from natural calamities, fire, and theft.

- Travel Insurance: Essential for international travelers. Covers flight cancellations, baggage loss, and medical emergencies abroad.

❌ What to Avoid:

- ULIPs (Unit Linked Insurance Plans): These are hybrid products mixing investment and insurance. They have high charges, low transparency, and often underperform.

- Endowment or Money-Back Policies: These offer low returns (4–5%) and poor coverage. You’re better off buying a term plan and investing the rest in SIPs or PPF.

Always keep insurance and investment separate. Insurance protects your income and wealth — it is not a wealth builder.

Pro Tips:

- Disclose all health conditions truthfully during policy application.

- Review and update your policies every 2–3 years.

- Ensure your nominee details are accurate and up to date.

Insurance gives you peace of mind knowing that if life throws a curveball, your loved ones won’t have to bear the financial burden alone.

🔹 9. Plan for Retirement Early

Planning for retirement early helps you build a large corpus with smaller monthly amounts. It gives you flexibility, peace of mind, and dignity in your later years. The best time to start was yesterday — the next best time is now.

Why Start in Your 20s or 30s:

- More time = Less pressure: When you start young, you can achieve your retirement target with smaller monthly investments. Waiting until your 40s or 50s requires you to contribute significantly more.

- Power of compounding: Compounding returns work best over long durations. Even a ₹2,000 monthly SIP started at age 25 can grow to over ₹1 crore by age 60.

- Flexibility in retirement age: Starting early may allow you to retire by 50 or 55 instead of 60–65, giving you more freedom and better health to enjoy your retirement.

💡 Best Tools for Retirement Planning:

- NPS (National Pension System): A long-term retirement-focused product offering market-linked returns and tax benefits. You can choose your asset allocation and annuity options.

- EPF (Employees’ Provident Fund): Mandatory for salaried employees. Contributions from both employer and employee grow over time and are tax-exempt under Section 80C.

- Long-Term Mutual Funds: SIPs in equity mutual funds are ideal for inflation-beating growth. Pair this with debt funds closer to retirement for stability.

- PPF & VPF (Public/Voluntary Provident Fund): Great for conservative savers seeking tax-free, guaranteed returns. 15-year lock-in ensures long-term savings discipline.

Actionable Tips:

- Use retirement calculators to estimate your post-retirement monthly needs. Account for inflation, lifestyle, healthcare, and travel.

- Reverse engineer the corpus required using SIP calculators.

- Start with what you can afford — ₹2,000–₹5,000/month is a good beginning.

- Increase contributions with every salary hike or annual bonus.

- Rebalance your portfolio every few years to reduce equity exposure closer to retirement.

Remember: retirement planning isn’t just about money — it’s about freedom. The freedom to live your later years on your terms, without financial anxiety.

🧮 Try our [Retirement Calculator] to stay on track (Coming soon)

🔹 10. Review & Adjust Regularly

Financial planning is not one-and-done. It must evolve with your income, lifestyle, family size, and market changes. Regular reviews allow you to stay on track with your financial goals, adapt to unexpected events, and take advantage of new opportunities.

Set a Reminder to Review:

✅ Monthly: Review Your Budget and Expenses

- Revisit your budget to ensure it aligns with actual spending.

- Identify any overspending in discretionary categories and adjust.

- Check if you are saving/investing the amount you planned.

- Look out for any recurring subscriptions or charges to cancel.

- Update your expense tracker or app with recent transactions.

📈 Quarterly: Track Your Goals and Investments

- Evaluate progress toward your financial goals (emergency fund, vacation, down payment, etc.).

- Review your SIP and mutual fund performance. Make sure your investments are aligned with your risk profile and goal timelines.

- Consider increasing your SIP amount if income has increased.

- Check if asset allocation between equity, debt, and other investments is still balanced.

📊 Annually: Evaluate Your Net Worth, Insurance, and Portfolio

- Calculate your net worth (Assets – Liabilities). Compare year over year to track improvement.

- Review your insurance coverage — both health and life — and increase if needed.

- Rebalance your investment portfolio: shift more toward debt instruments if you are nearing a goal.

- Do comprehensive tax planning — review deductions, exemptions, and investments to reduce tax liability.

- Update or revisit your will or estate plan if major life changes occurred.

Pro Tips:

- Use a recurring digital calendar reminder (monthly/quarterly/yearly).

- Create a Google Sheet or use apps like INDmoney or Monefy to compare past vs. current progress.

- Celebrate financial wins — paying off debt, reaching a savings target, or increasing investments.

Financial reviews help you course-correct before small issues become big problems. Think of them as your personal money check-up that keeps your financial health in top shape.

✅ Final Thoughts

You don’t need to be a financial expert — just be consistent and intentional. Financial success is less about mastering complex formulas and more about developing sound habits and sticking to them. It’s about showing up for your money every month, reviewing your progress, and making improvements over time.

By applying the steps outlined in this guide — setting clear goals, tracking your spending, building a budget, saving consistently, investing wisely, protecting yourself with insurance, and reviewing regularly — you’ll reduce financial stress, reach your goals faster, and build a stable future.

No matter where you’re starting from, remember that small changes add up. One saved rupee, one paid-off debt, one smart investment at a time — that’s how wealth is built. Stay focused, stay patient, and keep learning.

💬 Got questions or feedback? [Contact Us]

📩 Subscribe to our newsletter for weekly tips!

📎 Recommended Reads :

- How to Create a Monthly Budget

- Best Personal Finance Apps

- How to Build an Emergency Fund

- SIP vs Lump Sum Investing

- Passive Income Ideas for Beginners