Welcome to our all-in-one Guide to Investing—your complete roadmap to building wealth, achieving financial freedom, and mastering money in 2025.

Whether you’re just starting or looking to optimize your portfolio, this guide will direct you through every major aspect of investing.

This guide is ideal for:

- Complete beginners who don’t know where to start

- Intermediate investors looking to diversify or refine strategies

- Anyone in India or abroad who wants to make smarter financial decisions

🏦 A) Basics of Investing

Who it’s for: Beginners & early investors looking for clarity.

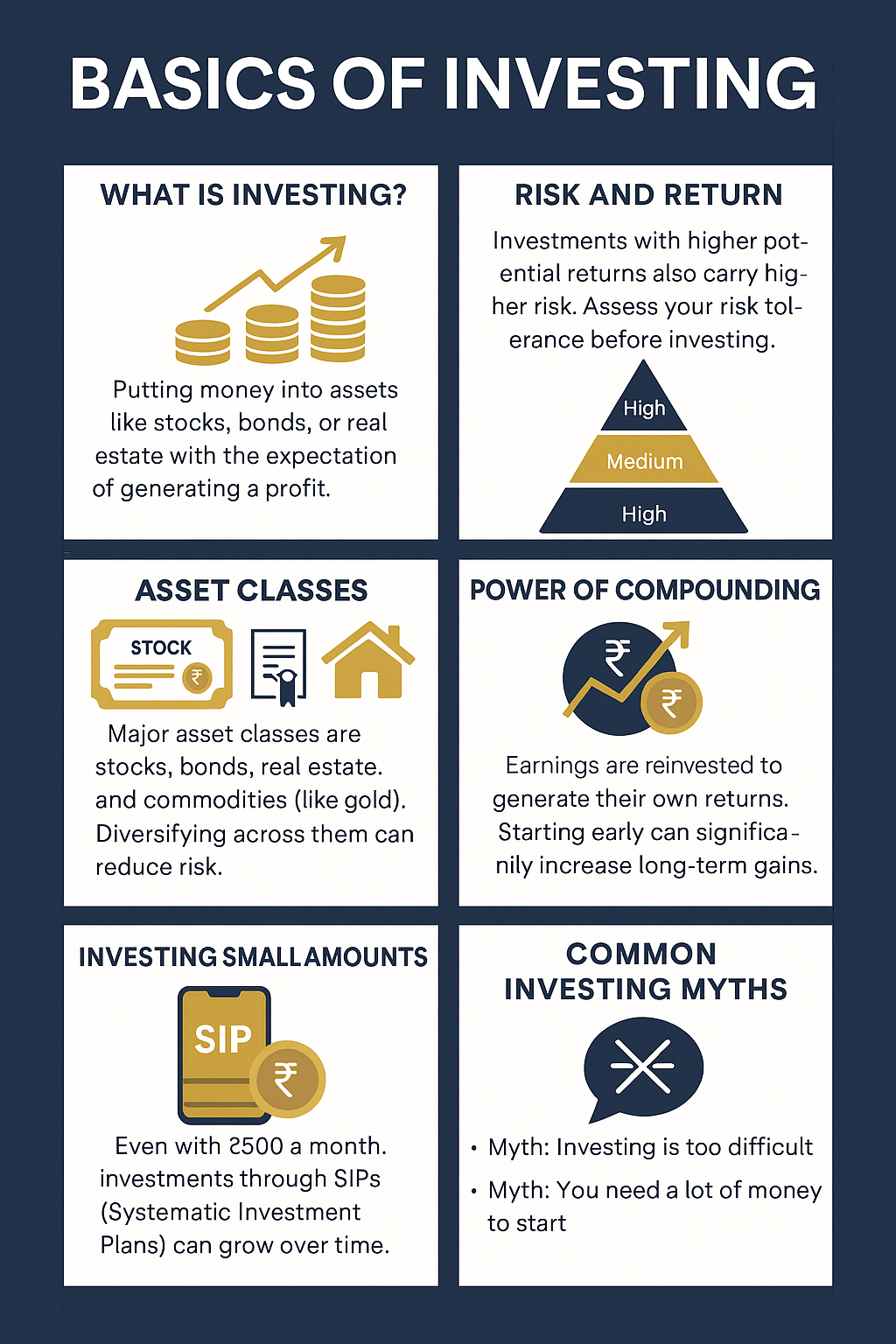

Investing is the foundation of financial success. But before you begin putting your money into markets or mutual funds, it’s important to understand the core principles.

Here, we break down what investing actually is, how it compares with saving, and why compound interest is often called the 8th wonder of the world.

We’ll also help you start small—even with just ₹500—and bust the biggest myths that stop Indians from starting their investment journey.

🔗 Read Full Article → Basics of Investing

Key Topics Covered:

- What is Investing?

Understand how investing means putting money into assets—like stocks, mutual funds, or gold—with the goal of growing it over time.

It’s how your money makes money. Real-life examples include buying a flat that appreciates or investing in mutual funds that grow with the market.

Think of it like planting a money tree—it takes care and time, but it grows. - Types of Investments (Asset Classes)

Get familiar with equity, debt, gold, real estate, crypto, and alternative assets.

Know which suits your goals and risk appetite. This section covers how to balance traditional vs modern investment types.

Each asset class has different liquidity, return potential, and tax implications, and your allocation should reflect your financial goals. - Risk vs Return (with Pyramid)

Every investment has risk. We use a pyramid to show which assets are safest and which offer higher potential rewards.

Visualize FD at the base, mutual funds in the middle, and stocks or crypto at the top. We’ll also explain volatility, standard deviation, and beta. - Power of Compounding

Learn how consistent small investments grow exponentially.

Use real-world examples like ₹5,000/month growing to ₹1 Cr. We’ll also explain the Rule of 72 and how time accelerates wealth.

Think of compounding as a snowball—start small, keep rolling. - How Much Should You Invest Monthly?

Use budgeting rules like 50/30/20 and calculate a safe investment amount based on your income.

Learn how to prioritize goals and adjust based on income fluctuations. We’ll walk you through sample income slabs and what percentage goes to investing. - Saving vs Investing

Savings protect your money; investing grows it. Know when to do what.

We’ll explore where to park your emergency fund vs long-term goals. For example, use an FD for emergencies but SIP for your child’s education. - Active vs Passive Investing

Decide if you want to manage your investments yourself or take a hands-off approach through index funds or SIPs.

Learn how passive strategies can outperform high-maintenance ones. We compare Warren Buffet-style index investing vs active trading. - Setting Financial Goals

Define your money milestones using the SMART goal framework before investing.

Learn how to match asset classes with goals like buying a house or early retirement. We’ll show how timelines affect the type of investments you should choose. - Investing with ₹500

Start with just ₹500/month via SIP in mutual funds using apps like Groww, Zerodha Coin, or Paytm Money.

Even a small start can lead to big rewards when done consistently. We’ll even show a ₹500/month SIP compounding chart. - Common Myths

Think investing is only for the rich? That it’s risky like gambling?

We break down the top 10 misconceptions and show why these outdated beliefs hurt your future wealth. We’ll debunk ideas like “stock market is only for experts.”

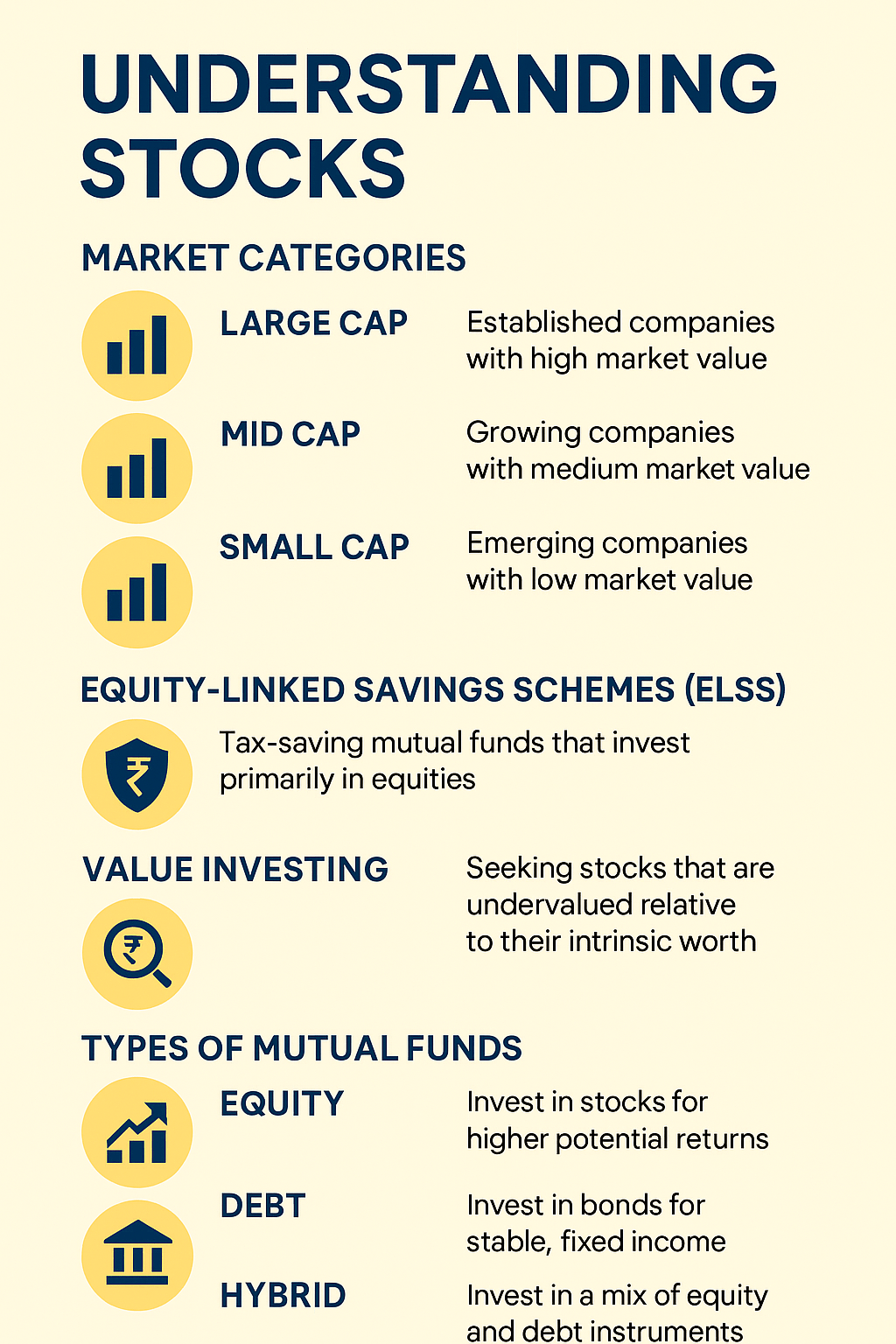

📈 B) Stock Market

Who it’s for: Intermediate learners and future equity investors.

The stock market can be your gateway to wealth—but only if you understand how it works.

This section is for people ready to explore individual stocks, equity mutual funds, and platforms like NSE/BSE or Nasdaq/S&P 500.

We explain how to open a Demat account, read basic stock charts, and compare popular brokers like Zerodha, Groww, Upstox, or Robinhood.

Whether you’re looking for stable dividend income or aiming to be a long-term investor, this section will help you take action with confidence.

🔗 Read Full Article → Stock Market Investing

Key Topics Covered:

- How to Invest in Stock Market

Step-by-step guide to getting started in India or the US including KYC, brokers, and fund transfers.

Learn about timing, minimum investment, and regulatory bodies like SEBI.

We break down the difference between primary and secondary markets. - Best Beginner Stocks (2025)

Discover stable companies with strong fundamentals and consistent returns.

These include blue-chip companies from FMCG, banking, IT, and pharma sectors that have strong earnings and low volatility. - Long-Term vs Short-Term

Weigh the difference in risk, reward, and strategy between holding stocks and trading frequently.

We’ll show how wealth builds through patience, not panic. - How to Read Stock Charts

Learn the basics of charts—like candlestick patterns—and what they tell you about market sentiment.

Understand support/resistance, volume spikes, and moving averages. - Top Investment Apps

Review the best trading platforms in India for charges, features, and ease of use.

Know which ones offer US stocks, analytics, and real-time data. - Opening a Demat Account

A complete walkthrough of opening your first trading account.

Know documents needed, costs involved, and timeline.

We’ll also help you link your bank and start trading. - Blue Chip vs Penny Stocks

Know when to go safe with blue chips and when you’re risking more with lesser-known stocks.

Explore examples like Infosys vs Vodafone Idea and their volatility. - Dividend Stocks

Earn passive income with dividend-paying companies—ideal for conservative investors.

Learn how to find payout ratios, upcoming ex-dividend dates, and yield calculations. - Stock Market Glossary

Learn key terms like EPS, P/E, Market Cap, and IPO with quick definitions. Master the lingo to boost confidence. - Mistakes to Avoid

Don’t panic-sell, overtrade, or chase tips. Learn from others’ errors.

This can save lakhs over the long term.

We’ll provide real case studies of new investors and what went wrong.

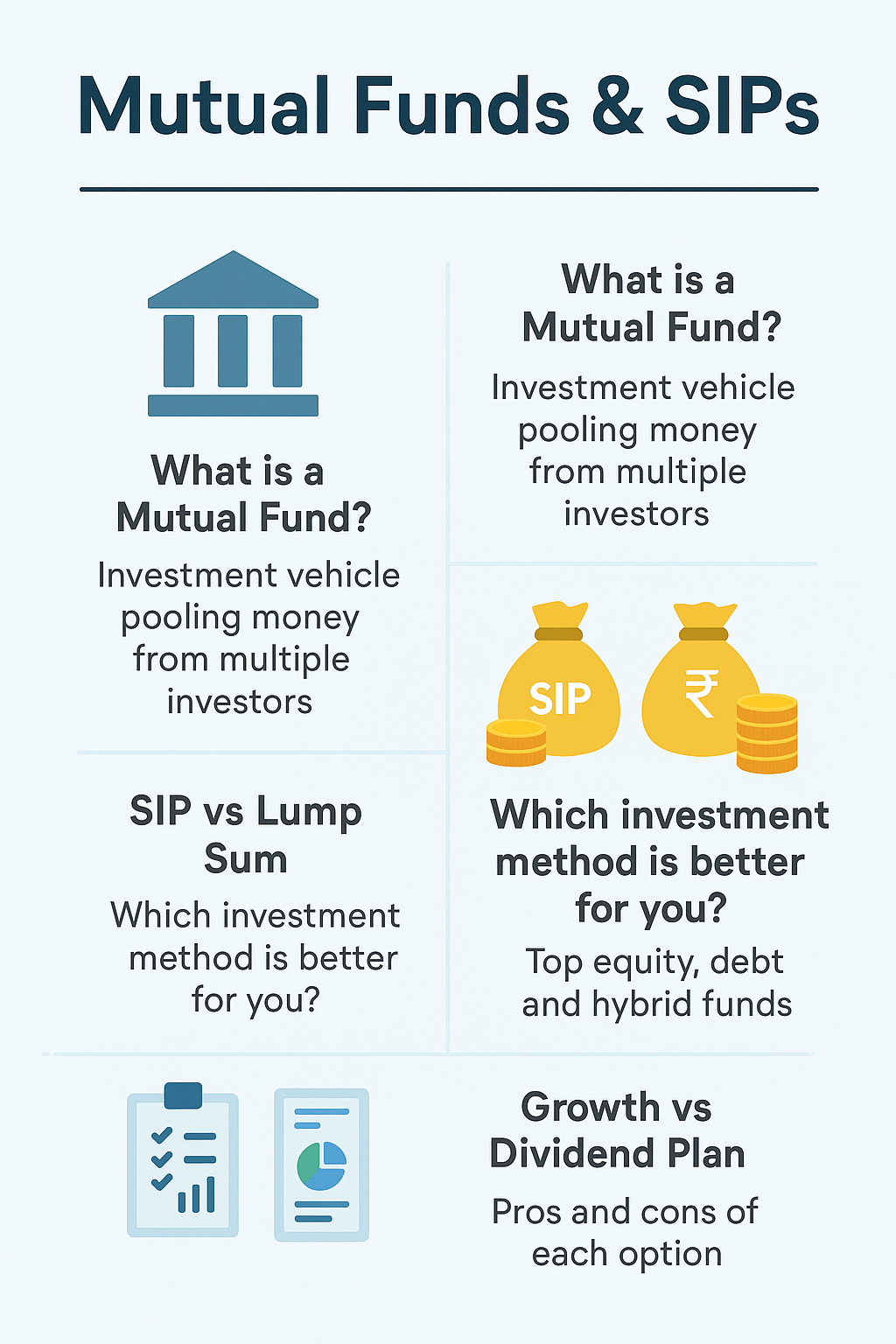

💰 C) Mutual Funds & SIPs

Who it’s for: Salaried individuals, passive investors & tax planners.

Don’t have time to track individual stocks? Mutual funds and SIPs are your best friends.

This section is designed to demystify how mutual funds work, how to pick the right one, and how to invest via SIP (Systematic Investment Plan).

We’ll guide you through growth vs dividend options, choosing direct vs regular plans, and even how to use mutual funds for saving taxes under 80C using ELSS.

🔗 Read Full Article → Mutual Funds & SIPs

Key Topics Covered:

- What is a Mutual Fund?

A mutual fund pools money from many investors and invests in diversified portfolios managed by professionals.

We’ll explain fund NAV, expense ratio, AUM, and how different types (equity, debt, hybrid, liquid) suit different goals. - SIP vs Lump Sum

SIPs let you invest small fixed amounts periodically; lump sum is for investing a large amount at once.

SIPs help average out market risk (Rupee Cost Averaging), while lump sum may benefit during market dips. - Top Funds for 2025

Our pick of high-performing funds across categories—large-cap, mid-cap, small-cap, hybrid, debt.

Includes fund managers, returns, AUM, and ratings from Value Research or Morningstar. - ELSS Funds (Tax Saving)

Save up to ₹46,800/year under 80C with ELSS (Equity Linked Saving Schemes).

Lock-in of 3 years, equity exposure, and wealth creation—makes it great for salaried individuals. - Direct vs Regular Plans

Direct funds have no distributor commissions—higher returns. Regular funds include intermediaries.

Know how to switch from regular to direct via platforms. - Top Mutual Fund Platforms

Groww, Kuvera, Zerodha Coin, ET Money—compare them based on features, fund access, fees, and reporting. - SIP Setup Guide

Learn how to start your first SIP in 10 minutes with KYC, bank mandate, and fund selection.

Screenshots, app walkthroughs, and mistakes to avoid included. - Choosing Funds by Goal

Short-term = liquid or ultra-short funds. Mid-term = balanced or hybrid funds. Long-term = equity.

Match duration and risk level to fund category. - Growth vs Dividend Plans

Growth reinvests returns (great for long-term compounding); dividend pays out intermittently.

Taxation and impact on NAV explained. - Hidden Charges in Mutual Funds

Understand Total Expense Ratio (TER), exit load, entry load, and how these impact long-term returns.

We’ll include a real calculation example.

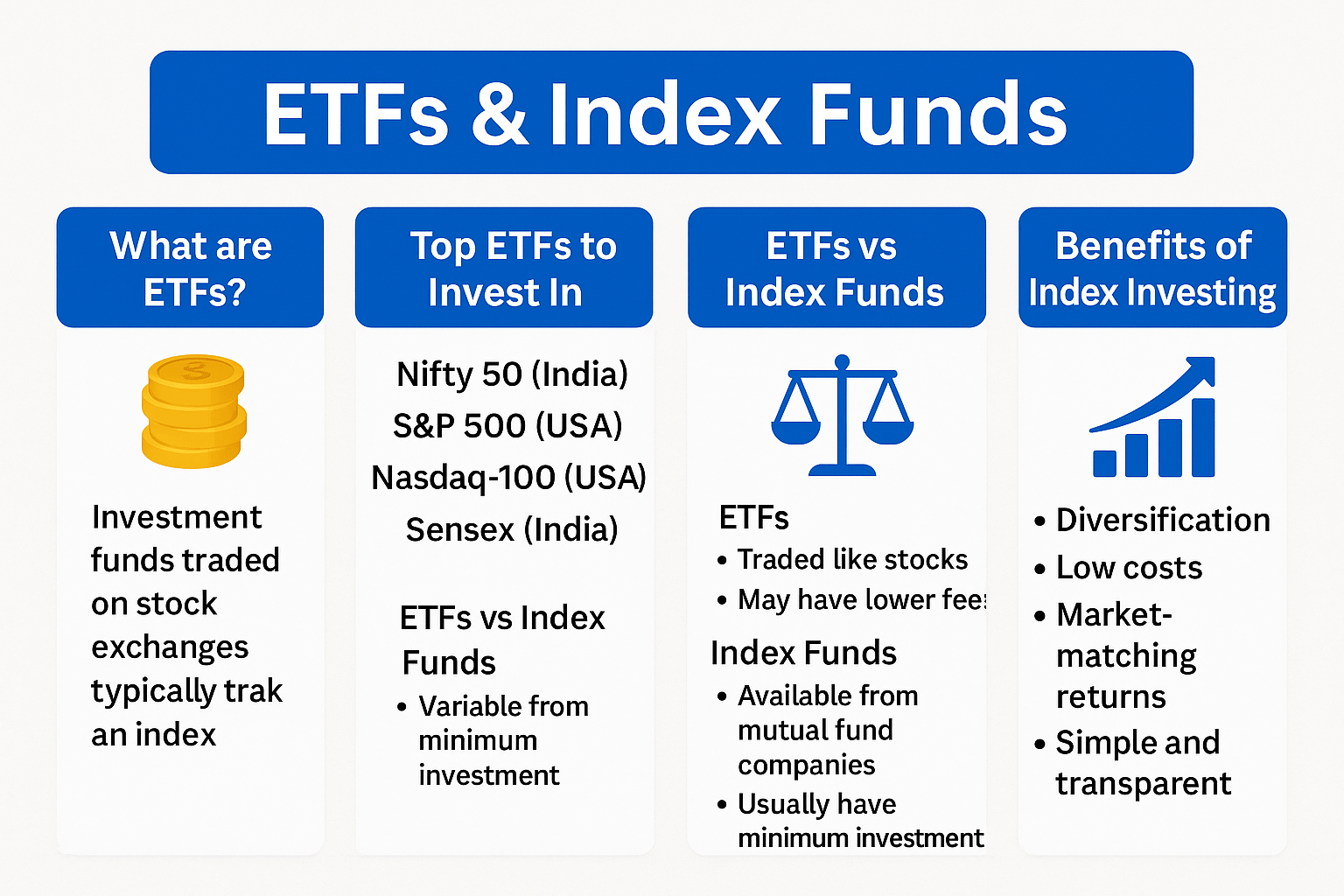

📊 D) ETFs & Index Funds

Who it’s for: Passive investors and long-term planners.

Exchange-Traded Funds (ETFs) and Index Funds are ideal for people who want broad market exposure without having to research individual stocks.

They’re low-cost, diversified, and great for building long-term wealth with minimal effort.

These options are gaining massive popularity in India, especially among new investors looking for lower-risk ways to invest in equities.

Learn what they are, how to invest, and which ones are best suited for your financial goals in 2025.

🔗 Read Full Article → ETFs & Index Funds

Key Topics Covered:

- What are ETFs?

ETFs are investment funds that trade on stock exchanges like individual stocks.

They hold a collection of assets like stocks or bonds and typically track a specific index.

Think of them as mutual funds you can buy and sell in real time. - Best ETFs in India & USA

Discover top-performing ETFs like Nippon India ETF Nifty BeES, ICICI Prudential Sensex ETF, and global options like Vanguard S&P 500 ETF or Invesco QQQ.

We cover returns, expense ratios, and liquidity. - ETFs vs Mutual Funds

ETFs are more flexible and usually have lower fees, but they require a Demat account.

Mutual funds offer SIPs and are easier for beginners. We compare tax treatment, ease of access, and use cases for each. - Index Investing for Beginners

Index funds passively track indices like Nifty 50, Sensex, S&P 500, or Nasdaq.

Learn why they outperform many actively managed funds over the long term.

Perfect for those who want simplicity and steady returns. - How to Buy ETFs in India

Open a Demat and trading account with brokers like Zerodha, Upstox, or Groww.

Learn how to analyze volume, price spreads, and expense ratios before you buy. - Top Index Funds 2025

Recommended options include HDFC Index Nifty 50 Plan, UTI Nifty Index Fund, and Motilal Oswal S&P 500 Index Fund.

We’ll compare historical returns, consistency, and cost. - Benefits of Passive Investing

Lower costs, diversification, and minimal effort.

Avoid stock picking stress and let the market work for you.

Ideal for long-term wealth creation. - International ETFs

Want global exposure? Learn how to invest in US or global indices from India using international ETFs.

Great for hedging currency risk and diversifying your holdings. - Sector ETFs

Target industries like IT, Pharma, FMCG, or Banking with thematic ETFs.

These are best for investors who want sector-specific exposure with ETF benefits. - Taxation of ETFs in India

Understand how ETFs are taxed—equity ETFs follow the same rules as stocks.

Learn about short-term capital gains (15%) and long-term (10% beyond ₹1 lakh).

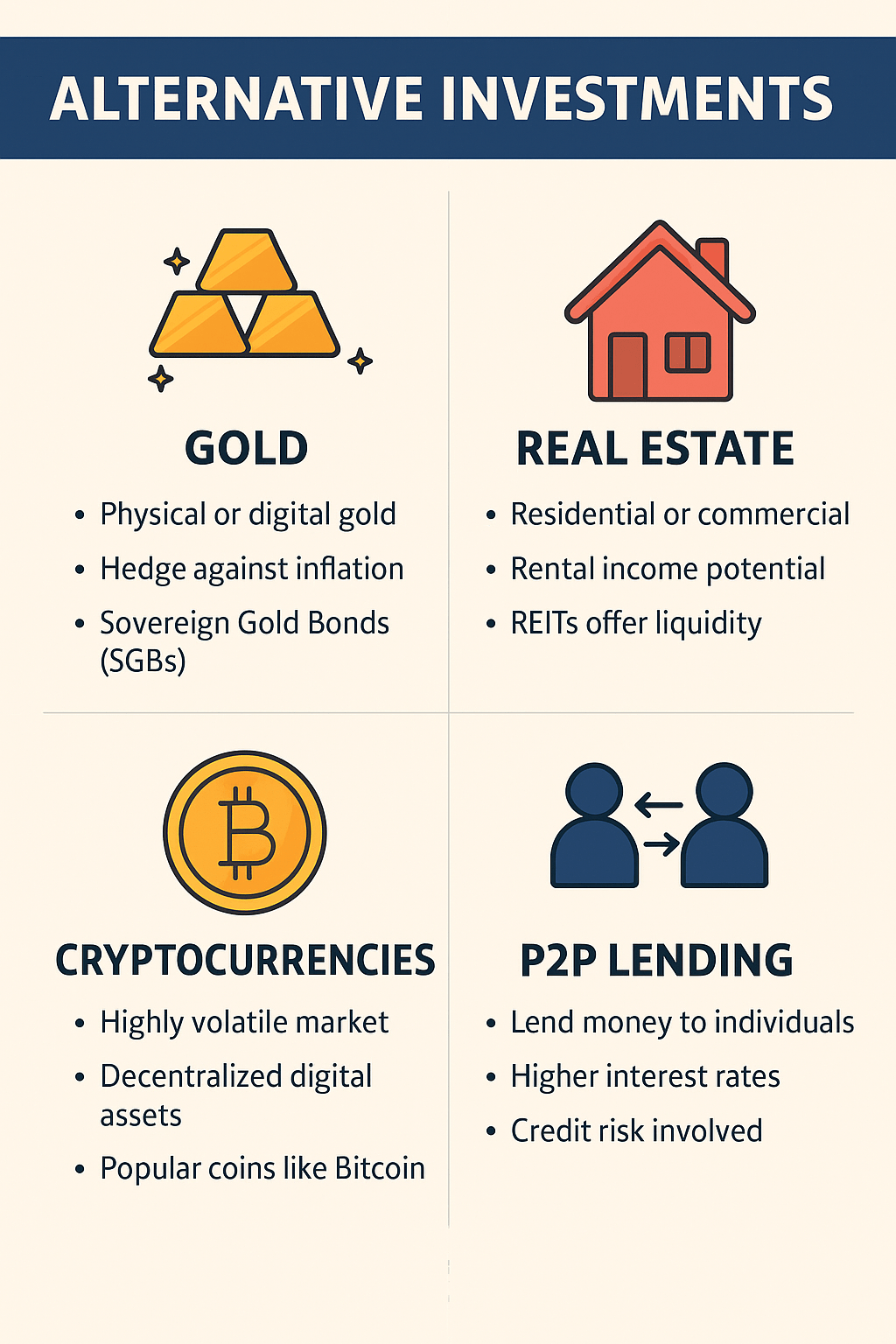

🪙 E) Alternative Investments

Who it’s for: Investors seeking diversification beyond traditional markets.

Alternative investments can provide a hedge against stock market volatility and give you access to unique asset classes.

Whether you’re looking at gold, real estate, cryptocurrencies, or post office schemes, these tools can play a strategic role in building a resilient financial portfolio.

This section covers regulated and emerging options so you can diversify smartly without taking on unnecessary risk.

🔗 Read Full Article → Alternative Investments

Key Topics Covered:

- Investing in Gold

Choose between physical gold, digital gold, and Sovereign Gold Bonds (SGBs).

Learn the pros and cons of each, including safety, returns, and storage. Understand how gold acts as a hedge against inflation and currency devaluation. - Real Estate Investment

Evaluate residential vs commercial property investments.

Understand rental yields, property appreciation, taxation on capital gains, and registration costs.

We also cover RERA compliance and legal due diligence. - REITs in India

Real Estate Investment Trusts allow you to invest in large-scale commercial real estate projects without buying property.

Learn about top Indian REITs like Embassy REIT and Mindspace Business Parks. - Crypto Investing for Beginners

Discover how Bitcoin, Ethereum, and other coins work.

Understand the basics of blockchain, wallets, and exchanges.

We’ll also add a clear disclaimer on the high risk and volatility of crypto assets. - Top Crypto Platforms in India

Explore CoinDCX, WazirX, ZebPay, and CoinSwitch. Compare features like KYC, transaction fees, token variety, and ease of withdrawal. - P2P Lending

Peer-to-peer lending platforms like Faircent and LenDenClub let you earn interest by lending money directly to borrowers.

We explain risk levels, expected returns, and borrower screening processes. - Sovereign Gold Bonds (SGBs)

Backed by the RBI and Government of India, SGBs offer 2.5% interest plus gold price appreciation.

Learn lock-in periods, tax benefits, and how to purchase through banks or brokers. - Post Office Investment Schemes

Options like PPF, NSC, and Senior Citizen Savings Scheme offer fixed returns and tax benefits.

These are safe, government-backed options suitable for conservative investors. - NPS for Retirement Planning

The National Pension System offers equity and debt exposure with tax-saving benefits.

Learn about Tier I vs Tier II accounts, fund managers, and withdrawal rules. - Is Alternative Investing Right for You?

We’ll help you decide based on your risk tolerance, goals, and investment horizon.

Diversification doesn’t mean betting on everything—just allocating smartly.

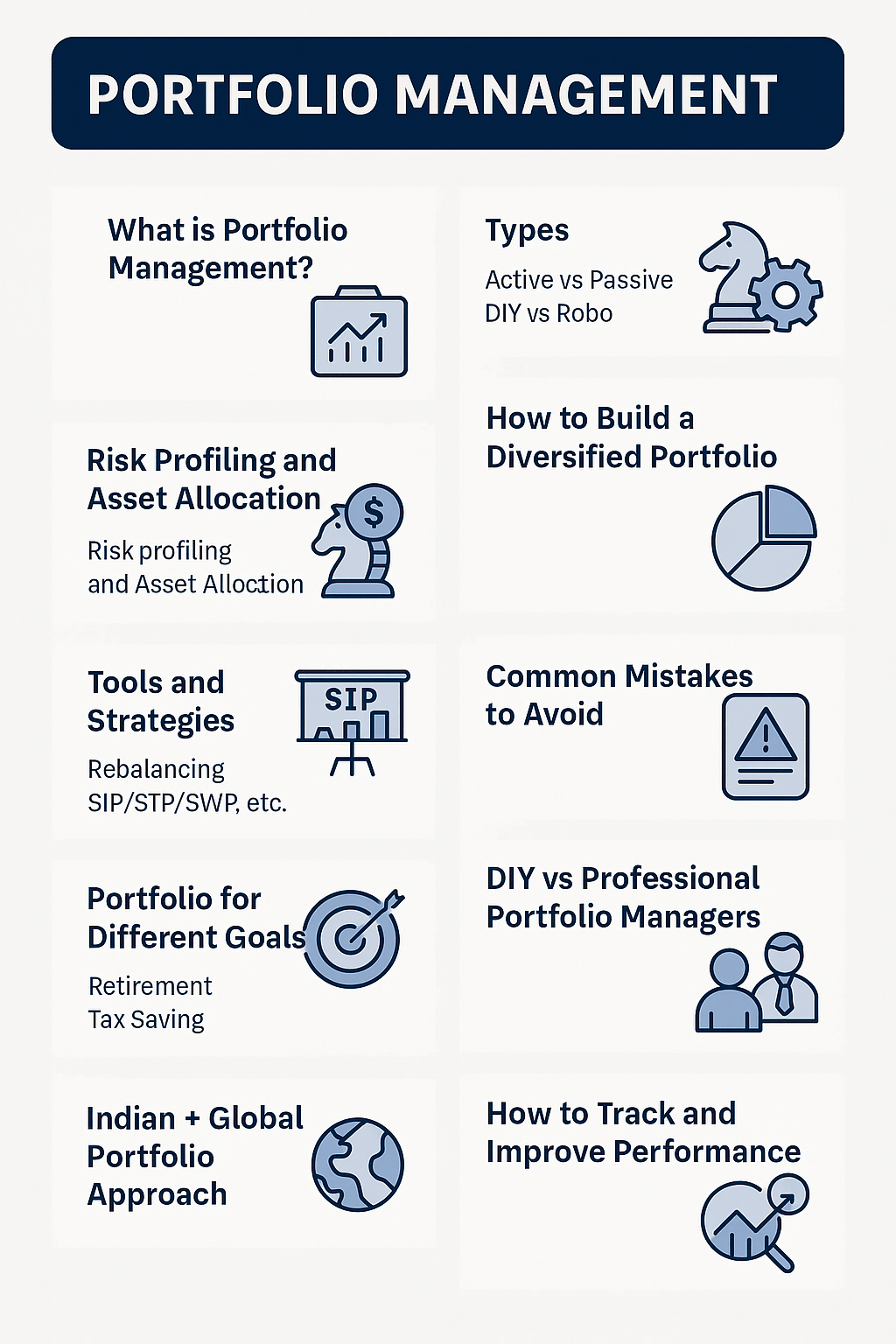

💼 F) Portfolio Management

Who it’s for: DIY investors, young professionals, and retirement planners.

Once you’ve started investing across multiple asset classes, managing your portfolio becomes critical.

Portfolio management isn’t just about picking the right stocks or mutual funds—it’s about balancing, reviewing, and optimizing everything you own to meet your life goals.

This section teaches you how to construct, track, and maintain a healthy investment portfolio tailored to your age, income, and risk tolerance.

🔗 Read Full Article → Portfolio Management

Key Topics Covered:

- How to Build a Diversified Portfolio

Allocate funds across equity, debt, gold, and alternatives to reduce overall risk.

Use strategies like the 70/30 rule or 60/20/20 based on your goals.

Learn how diversification smooths returns during market cycles. - Asset Allocation by Age & Risk Profile

Follow age-based thumb rules like “100 minus your age = equity exposure.” Customize for aggressive, balanced, and conservative risk appetites.

Real examples for ages 25, 35, and 50. - Portfolio Rebalancing: When & How

Set a calendar (semi-annually or annually) to review your portfolio and bring it back to your target allocation.

Learn how to rebalance manually or through tools like Kuvera or ET Money. - SIP + Stock + Gold: Ideal Portfolio Example

Combine monthly SIPs in mutual funds with long-term blue-chip stocks and 10–15% gold via SGBs or ETFs.

Visual diagram included for a ₹10 lakh model portfolio. - Portfolio Tracking Tools & Apps

Use apps like INDmoney, Kuvera, ET Money, and Zerodha Console to monitor gains, XIRR, asset weightage, and rebalancing alerts. - Investing by Life Stages

20s = risk-taking growth phase. 30s = child + house goals. 40s = stability and retirement.

Tailor strategies for each decade with case studies. - Common Mistakes in Portfolio Management

Avoid over-diversification, ignoring rebalancing, and emotional reactions.

Learn how to audit your holdings every 6–12 months. - Emergency Fund Importance

Before investing, build an emergency fund with 3–6 months’ expenses in liquid or ultra-short-term debt funds.

This is your safety cushion. - Annual Portfolio Review Guide

Use checklists to assess underperforming funds, overweight sectors, and new opportunities.

Realign goals if income or life changes. - DIY vs Robo vs Financial Advisor

Compare doing it yourself using apps, hiring a financial advisor, or using robo-advisors like Scripbox and Paytm Money.

Learn what’s best based on your budget and experience.

This completes your comprehensive Guide to Investing. It is designed to guide readers through every stage of their investment journey—from foundational knowledge to portfolio mastery.

This completes your comprehensive Investing.

It is designed to guide readers through every stage of their investment journey—from foundational knowledge to portfolio mastery.

🧠 Frequently Asked Questions (FAQs)

1. What is the best investment option for beginners in 2025?

For most beginners, mutual funds through SIPs (Systematic Investment Plans) are a great way to start.

They offer diversification, professional management, and can start with as little as ₹500/month.

2. How much money should I invest monthly?

Follow the 50/30/20 rule. Allocate 20% of your monthly income towards investments after covering essential expenses and wants.

Use tools like SIP calculators to decide the right amount.

3. What’s the difference between ETFs and Mutual Funds?

ETFs trade like stocks on an exchange, offer lower fees, and require a Demat account.

Mutual funds can be bought without a Demat account and offer SIP options. Both can track the same index.

4. Is the stock market too risky for new investors?

Not if approached properly. Start with blue-chip stocks or index funds. Educate yourself and invest with a long-term view.

Avoid day trading unless you fully understand the risks.

5. How do I choose the right mutual fund?

Align the fund type (equity, debt, hybrid) with your financial goal. Look at past performance, fund manager history, AUM, and expense ratio.

Use platforms like Groww or Kuvera for comparison.

6. What is compounding and why is it important?

Compounding is when your returns earn returns. For example, investing ₹5,000/month for 20 years at 12% can grow to over ₹50 lakhs.

The earlier you start, the more powerful it becomes.

7. Are Sovereign Gold Bonds better than physical gold?

Yes, SGBs offer 2.5% annual interest and capital gains tax exemption after 8 years. They’re safe, RBI-backed, and eliminate storage risks.

8. Do I need a financial advisor?

If you’re unsure about goals or asset allocation, a SEBI-registered advisor can help. Otherwise, DIY investors can use robo-advisors or learn through apps and credible financial blogs.

9. Can I invest in US stocks from India?

Yes, using platforms like INDmoney, Vested, or Groww Global.

You can invest under RBI’s Liberalised Remittance Scheme (LRS) up to $250,000 annually.

10. How often should I review my investment portfolio?

At least once every 6–12 months. Review asset allocation, fund performance, and financial goals. Rebalance if your investments drift too far from your plan.