Investing is the act of putting your money to work in assets or ventures with the expectation of earning a return or profit over time.

The basics of investing go beyond just saving money—while saving helps preserve your funds with minimal risk, investing focuses on growing your wealth.

This section introduces the foundational concepts every investor should understand, with real-life examples and simple explanations to help you get started

- 1. What is Investing?

- 2. Types of Investments (Asset Classes Explained)

- 3. Risk vs Return Explained (Including the Risk Pyramid)

- Power of Compounding (Explained with Real Examples)

- 5. How Much Should You Invest Monthly?

- 6. Difference Between Saving and Investing

- 7. Active vs Passive Investing

- 8. How to Set Financial Goals for Investment

- 9. Beginner’s Guide to Starting With ₹500 Investment

- Myths About Investing in India

1. What is Investing?

Investing is the act of putting your money into assets—such as stocks, mutual funds, real estate, or gold—with the goal of growing its value or generating income over time. Unlike saving, which preserves money, investing aims to build wealth.

✅ Real-Life Example:

If you buy ₹10,000 worth of mutual fund units today and they grow to ₹15,000 in 3 years, that ₹5,000 gain is your investment return.

Similarly, purchasing shares of a company that pays dividends means you earn money simply by holding that stock.

Examples:

- Stocks: Buying shares of a company like Tata Consultancy Services or Apple means you own a tiny part of that company. If the company grows, your share value might go up. Many stocks also pay dividends (a share of profits) quarterly.

- Real Estate: Purchasing a small apartment and renting it out provides monthly rental income, and the property itself may appreciate over years.

- Business or Project: Investing in a friend’s startup or a new cafe – if it succeeds, your initial capital could earn a profit.

Key takeaway: Investing is not a get-rich-quick scheme – it’s about patience and letting returns compound.

It differs from speculation or gambling, where people chase short-term price swings.

By investing in assets (businesses, properties, funds, etc.), you harness economic growth for your benefit. Anyone can start investing with even small amounts (as we’ll see in topic 9 below!).

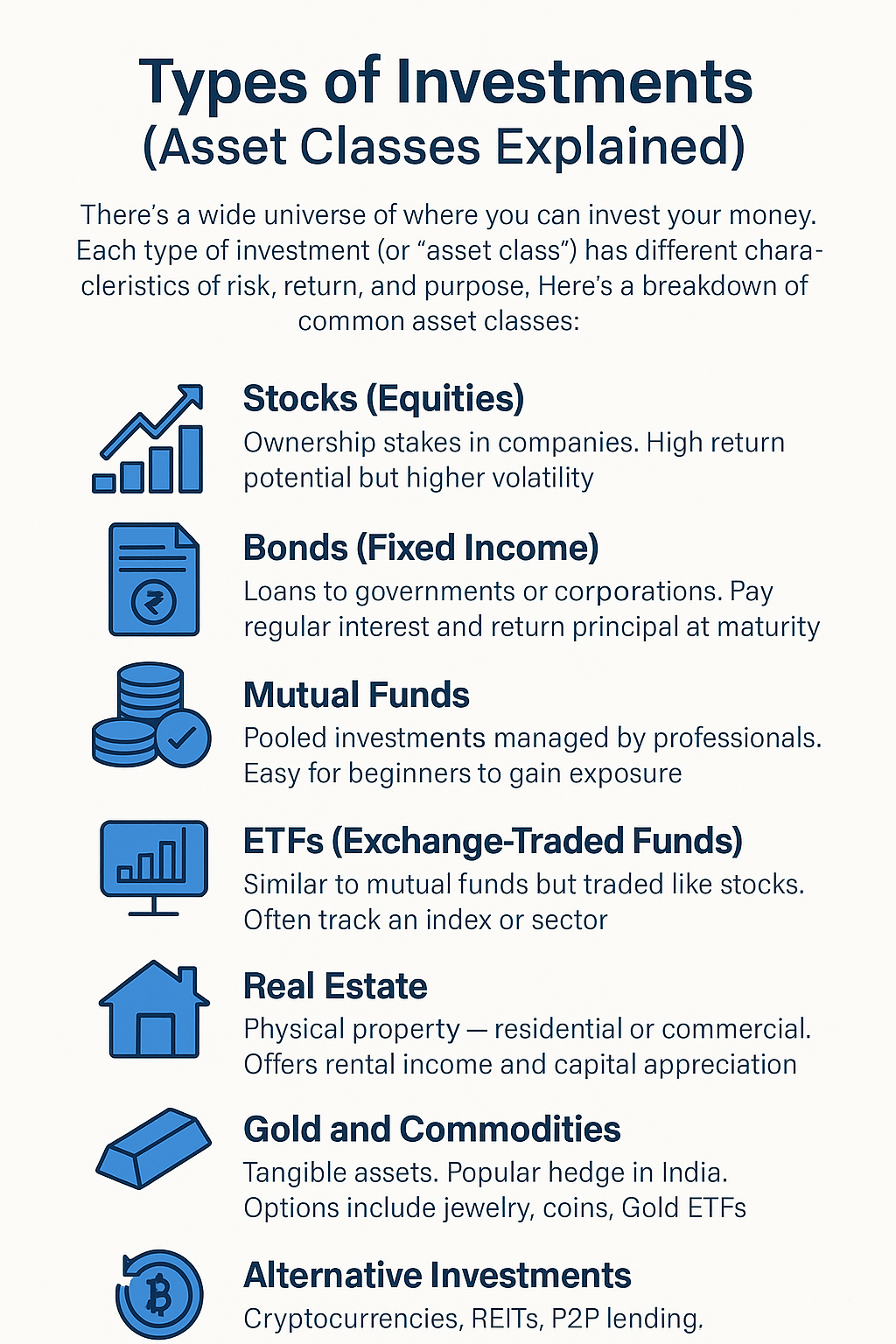

2. Types of Investments (Asset Classes Explained)

Investments are grouped into different asset classes, each with unique levels of risk, return, and purpose. Here are the main types:

- Stocks (Equities): Buying ownership in companies. High return potential but also higher risk.

Example: Shares of TCS, Reliance, or Apple. - Bonds (Fixed Income): Lending money to governments or companies for regular interest and principal repayment.

Example: Government bonds, corporate bonds, fixed deposits. - Mutual Funds: Pooled funds managed by professionals to invest in stocks or bonds. Ideal for beginners due to diversification.

Example: SBI Bluechip Fund, Axis Long Term Equity Fund. - ETFs (Exchange-Traded Funds): Like mutual funds but traded like stocks on exchanges. Low-cost and passive investing.

Example: Nifty 50 ETF, Nasdaq-100 ETF. - Real Estate: Investing in property for rental income or long-term appreciation. Requires higher capital and is less liquid.

Example: Buying a rental flat or commercial shop. - Gold and Commodities: Physical assets like gold, silver, or oil. Often used as a hedge against inflation.

Example: Gold ETFs, Sovereign Gold Bonds. - Alternative Investments: High-risk or unconventional options like cryptocurrency, REITs, P2P lending, or collectibles.

Example: Bitcoin, real estate investment trusts.

Pro Tip: Beginners should start with mutual funds or index ETFs and slowly diversify across asset classes to reduce risk.

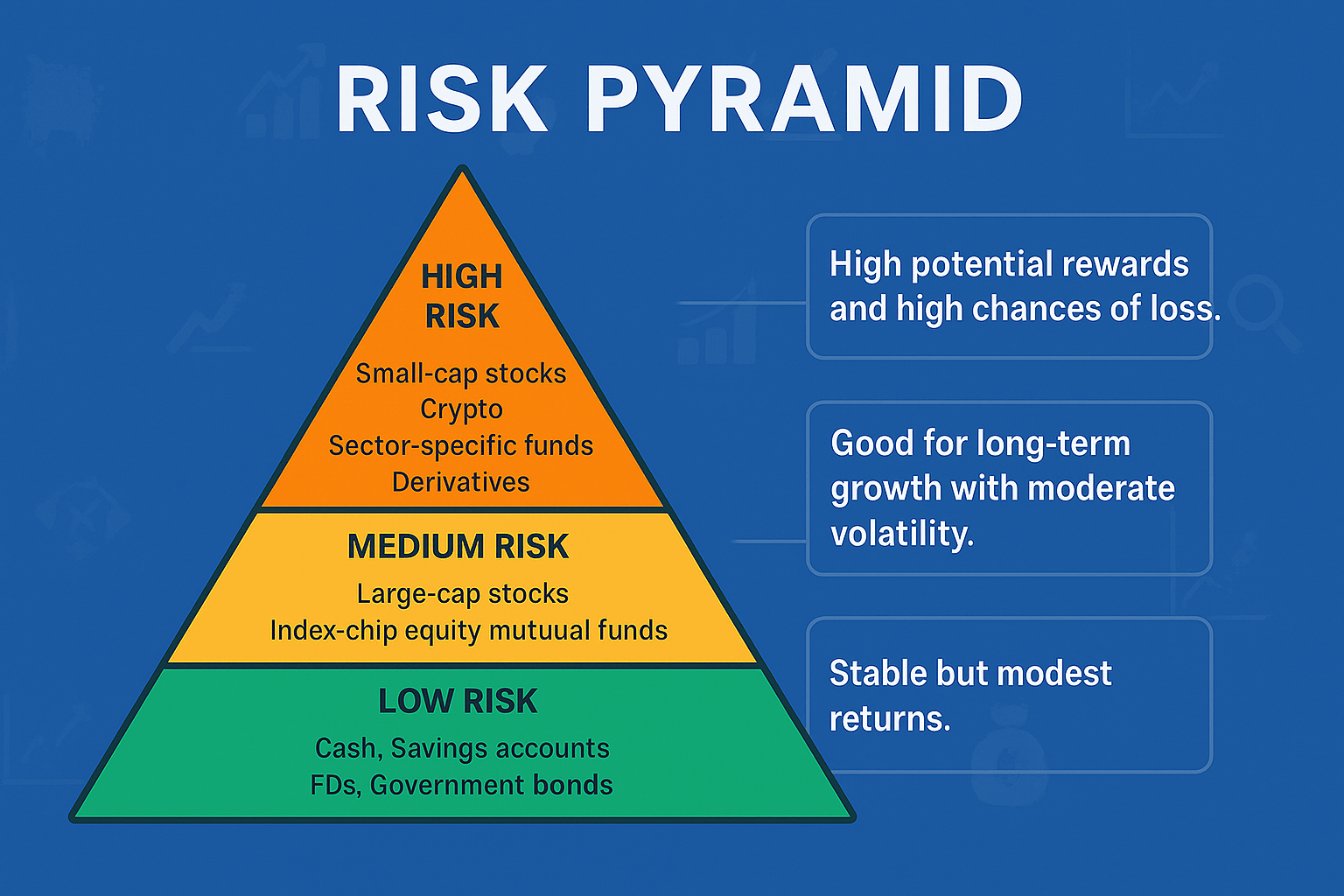

3. Risk vs Return Explained (Including the Risk Pyramid)

The core principle of investing is the risk-return tradeoff: higher potential returns usually come with higher risk.

Safe investments like FDs or savings accounts offer lower returns. Riskier assets like stocks or crypto can deliver higher gains – or losses.

Risk Pyramid:

- Base – Low Risk: Cash, savings accounts, FDs, government bonds. Stable but modest returns.

- Middle – Medium Risk: Large-cap stocks, index funds, blue-chip equity mutual funds. Good for long-term growth with moderate volatility.

- Top – High Risk: Small-cap stocks, crypto, sector-specific funds, derivatives. High potential rewards and high chances of loss.

Example: Between 2000 and 2020, the NIFTY 50 returned ~10.8% annually despite market fluctuations. Meanwhile, savings accounts earned much less. Stocks delivered better returns long-term, but required patience and discipline.

Between 2020 and 2025, the NIFTY 50 delivered an approximate annual return of ~13%, despite challenges like the COVID-19 pandemic, inflation concerns, and global market volatility.

In comparison, savings accounts during this period offered annual returns of just 2.5% to 4%. This highlights how long-term equity investing—though volatile—can significantly outperform traditional saving methods if approached with patience and discipline.

Key tip: Assess your risk tolerance. Young investors can typically handle more equity risk, while retirees prefer safer fixed-income options. Use the pyramid to guide your asset allocation.

Power of Compounding (Explained with Real Examples)

Compounding is the process where your investment earns returns, and those returns start earning returns too. It’s often called the “8th wonder of the world” because of its exponential growth effect over time.

🔁 How Compounding Works:

- Example: Invest ₹1,000 at a 10% annual return.

- Year 1: You earn ₹100.

- Year 2: You earn ₹110—on both the original ₹1,000 and the ₹100 gained earlier.

Over time, this snowball effect grows your money faster the longer you stay invested.

Real-World Example:

- Start a SIP of ₹500/month at age 25 earning 8% annually.

- By age 60, your corpus could grow to ₹14–15 lakhs from just ₹2.1 lakhs invested.

- Delay that by 10 years and the final value may be less than half.

Use Calculators:

Try free online tools like our own SIP calculator.

- ₹10,000/month for 20 years at 12% – 13% annual return = ₹1 crore+.

✅ Key Takeaways:

- Start investing early

- Stay consistent

- Reinvest earnings

- Avoid compounding debt (credit cards, EMIs, etc.)

Compounding is one of the most powerful ways to build wealth—time and discipline are your best allies.

5. How Much Should You Invest Monthly?

One common question is: “How much of my income should I invest?” The answer depends on your income, expenses, and financial goals, but here are some helpful guidelines:

- Follow the 50/30/20 Rule: Allocate 50% of income to needs, 30% to wants, and 20% to savings or investments. For example, with a ₹50,000/month income, aim to invest ₹10,000.

- Start Small if Needed: Can’t afford 20%? Begin with ₹2,000–₹5,000 per month and gradually increase. The habit is more important than the amount.

- Boost with Raises: Whenever your income increases, increase SIP contributions by 5–10% annually to stay ahead of lifestyle inflation.

- Back-calculate from Goals: Use a retirement or goal calculator to estimate how much you need to invest monthly to reach specific milestones.

- Don’t Overstretch: Always maintain enough cash for expenses and emergencies. If needed, reduce temporarily — but stay consistent overall.

Rule of Thumb: Invest 15–20% of your income consistently. Start early, and you’ll likely build a solid financial future. Even small, regular investments compound over time.

6. Difference Between Saving and Investing

Both saving and investing are essential, but they serve different purposes. Here’s a clear breakdown:

| Saving 💰 | Investing 📈 |

|---|---|

| Safe storage of money for short-term needs (vacation, emergency fund) | Growing money for long-term goals (retirement, education, buying a house) |

| Very low risk – money is usually in bank savings or fixed deposits | Higher risk – value may fluctuate due to market ups and downs |

| Low returns – may barely beat inflation | Potentially higher returns – historically outpaces inflation |

| Highly liquid – easy to access anytime | May have lock-in periods or exit charges (e.g., PPF, ELSS, real estate) |

| Short-term time horizon (0–3 years) | Best for medium to long-term (3+ years) |

Key takeaway: Use savings for short-term needs and emergencies. Invest for long-term wealth creation. A healthy financial plan includes both.

7. Active vs Passive Investing

Active and passive investing are two major strategies for managing your portfolio:

Active Investing

- Involves frequent buying/selling based on analysis, trends, and timing the market.

- Examples: Actively managed mutual funds or trading individual stocks yourself.

- Pros: Potential to beat the market and adapt to changing conditions.

- Cons: Higher fees, more effort, and harder to consistently outperform indexes.

Passive Investing

- Invests in index funds or ETFs that simply track market benchmarks like Nifty 50 or S&P 500.

- No effort needed to pick winners – you buy and hold the entire market.

- Pros: Low cost, reliable long-term returns, less stress.

- Cons: You only get market-average returns (which may be low short-term).

Real Example: Index funds often outperform most actively managed funds after fees. For example, many Nifty 50 index funds have beaten expensive flexi-cap or mid-cap funds over 10 years.

Which to choose? For most beginners, passive investing is a safer, lower-cost way to start. Once confident, you can add some active strategies or managed funds for diversification.

In short: Active = hands-on & high effort. Passive = hands-off & lower cost. Combine both as per your comfort and knowledge.

8. How to Set Financial Goals for Investment

Investing without clear goals is like sailing without a destination. Setting financial goals gives your investments direction and purpose. Here’s how you can do it effectively:

Steps to Set Financial Goals:

- Identify Your Goals: Retirement, child’s education, buying a home, travel, or achieving financial independence.

- Attach a Time Horizon: Classify goals as short-term (0–3 years), medium-term (3–7 years), or long-term (7+ years).

- Estimate the Future Value: Account for inflation using online future value calculators.

- Choose Investment Strategy:

- Short-Term (≤3 years): Use FDs, debt mutual funds, or RDs.

- Medium-Term (3–7 years): Use hybrid or balanced mutual funds.

- Long-Term (7+ years): Invest in equity mutual funds, index funds, or stocks.

- Follow SMART Goals: Specific, Measurable, Achievable, Relevant, Time-bound (e.g., “Save ₹20 lakhs for house down payment by 2028”).

- Review Periodically: Adjust your goals annually based on income, market performance, or life events.

Pro Tip: Use investment apps to track your progress toward each labeled goal — e.g., “Car Fund” or “Vacation Fund”. Prioritize retirement and emergency funds before other goals.

9. Beginner’s Guide to Starting With ₹500 Investment

You don’t need a large amount to begin investing. Here’s how you can start with just ₹500:

- Open an Investment Account: Use apps like Zerodha, Groww, or Paytm Money. Complete KYC online.

- Start a Mutual Fund SIP: Begin with as little as ₹500/month in index funds like Nifty 50 or balanced funds.

- Buy Low-Cost Stocks: Many public sector or ETF stocks are under ₹500/share. Some platforms also offer fractional shares of U.S. stocks.

- Invest in Digital Gold or SGB: Buy gold in fractional grams via apps or invest in Sovereign Gold Bonds when available.

- Use RDs or Post Office Schemes: Safe options for risk-averse investors that build discipline.

- Explore Fintech Platforms: New-age apps allow investing spare change or ₹100–500 into diversified portfolios. Ensure RBI regulation.

Bottom Line: The key is to start. Even ₹500 builds the habit. Over time, you’ll gain knowledge, comfort, and returns.

User our free sip calculator to calculate how much return you will get – SIP Calculator

Myths About Investing in India

Let’s bust some of the most common myths that hold people back from investing:

Myth 1: You Need a Lot of Money

Reality: Start with as little as ₹100 or ₹500 via SIPs or stocks. Small beginnings lead to large portfolios over time.

Myth 2: The Stock Market is Gambling

Reality: Stock investing is based on real business performance. Unlike gambling, you can manage risk with knowledge and diversification.

Myth 3: Investing is Too Complicated

Reality: Tools like index funds, robo-advisors, and educational content make investing accessible for everyone.

Myth 4: I Should Wait for the “Right Time”

Reality: Time in the market beats timing the market. Start early and invest regularly — SIPs help average your costs.

Myth 5: Gold and Real Estate Are Safer

Reality: While valuable, they have risks too. Diversification is the real key. Equities often outperform long-term and provide liquidity.

Myth 6: FDs Are Enough

Reality: FDs barely beat inflation. Long-term growth requires equity exposure, especially for retirement or wealth creation.

Final Thought: Don’t let outdated beliefs stop you from investing. With SEBI/RBI regulation and smart tools, India offers plenty of safe, efficient investing options.